Productivity is the key to successful business growth in the hyperactive and highly competitive insurance industry. Agents in the insurance industry are continuously searching for methods to increase their productivity and efficiency and keep up with the competition. The year 2024 is approaching, and insurance agents are beginning to search for new ways to maximize their productivity and efficiency.

One of the key methods to achieve an increase in insurance agent productivity in 2024 is to accept technology. In general, insurance agents who combine digital tools and CRM systems report a 20% increase in sales figures. Technology can center insurance agents to automate repetitive jobs, for instance, data input and lead generation, thereby enabling them to concentrate more on important tasks for instance, building client relationships.

Another way to boost insurance agent productivity in 2024 is to provide ongoing training and development. Insurance agents who receive regular training and development opportunities are better equipped to handle complex situations and provide excellent customer service. Insurance agencies can increase their productivity and profitability by investing in their employees in the long run.

Leveraging Technology for Efficiency

In the modern world, where people are very busy and need more time, insurance agents should be ahead of their competitors by using technology that helps them be efficient. Agents can adopt the most advanced tools and software for process automation, efficient workflow, and personalized customer service, consequently increasing the quality of the services. The below are highly effective technological tools to help insurance agent productivity. Insurance agents should always be aware of the best insurance available.

CRM Systems

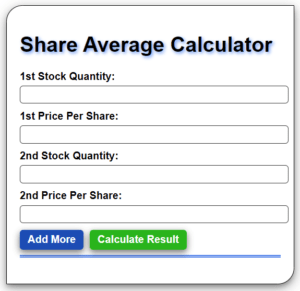

A CRM (Customer Relationship Management) system can allow insurance agents to manage all leads, clientele, and policies more efficiently. Thanks to the CRM system, agents can monitor client communications, set follow-up deadlines, and automate routine tasks such as replying to emails and producing reports. Insurance agents widely utilize Salesforce, HubSpot, and Zoho as CRM systems.

Mobile Applications

Mobile applications will enable agents to work on the move and maintain a good bond with their customers. Agents with this mobile app can use their CRM system to send quotes and manage policies from their smartphone or tablet. Some insurance companies also give their agents mobile apps, which can be used to access product information, make claim submissions, and conduct payment processing.

Automated Marketing Tools

Insurance agents can take advantage of using marketing automation, which can help to contact potential customers and maintain relationships with existing ones at the same time. Marketing tools useful for developing email campaigns, social media posts, and landing pages to increase marketing and promotion. Among the most known automated marketing tools that are in use by insurance agents today are tools such as Mailchimp, Constant Contact, and Hootsuite.

Utilization of technology for higher productivity can in turn accelerate insurance agents’ output and customer service quality. It is a CRM system, a mobile app, or an automated marketing device with the right technology that enables agents to stay disorganized, save time, and concentrate on what they like doing best and that is building relationships with the customers.

Time Management Strategies

Effective time management is essential for increasing insurance agent productivity. Time is of the essence in whatever industry you may be in, so it is necessary to know how to use time effectively and which tasks are the most crucial. Below are some strategies for time management that can help insurance agents to increase their productivity.

Another technique is the ABC Method, which involves categorizing tasks into three categories: A, B, and C. Firstly, all the most important work should be accomplished followed by spending some time on B and finally C. The method allows officers to apportion their time in accordance to the level of tasks’ gravity, and not to be involved in pointless tasks.

Delegation and Outsourcing

Delegation and outsourcing are not only crucial in achieving greater productivity, but they are also fundamental strategies for doing this. Agents should be able to co-opt tasks while managing time; hence, they can delegate administrative tasks that can be attended to by someone else. Agents can then dedicate their time to these vital functions rather than doing mundane tasks.

When talking of the employment strategy I would like to introduce also outsourcing which would mean giving away your tasks. Agents may opt for outsourcing different marketing, social media, or sales lead generation among others to third-party providers. This enables them to do external functions while doing main tasks.

In general, having control over working and time management can improve an insurance agent’s effectiveness. Techniques such as prioritization and task allocation are useful when fighting for agents’ goals and ensuring that critical tasks do not become bottlenecks.

Training and Development for Insurance Agent Productivity

Insurance agents must continuously learn and enhance their sales skills to increase insurance agent productivity.

Continuous Learning

It is a well-known fact that the insurance market is continually evolving and the agents who regularly stay up to date with the new products, rules, and selling methods triumph over others. The agents, who regularly attend refresher courses end up selling 15% more than others. Insurance companies are now a great chance to form online courses, webinars, and workshops for insurance agents to help them stay aware of new trends and techniques.

Lifelong learning appears in different forms, which include attending industry conferences, reading trade publications, and joining online forums. Insurance companies may also offer their agents contact with industry experts who can respond to their queries and help on complicated topics.

Sales Skills Enhancement

Sales skills are critical for insurance agents, and enhancing them can increase their productivity. Insurance companies should invest in training programs focusing on sales skills such as prospecting, objection handling, and closing techniques.

Role-playing exercises and one-on-one coaching with experienced sales professionals are equally important skills for insurance agents. These exercises can be used to figure out where the agents need improvement and how they should be overcome. Insurance companies that invest in training and development programs for their agents can increase productivity, improve customer satisfaction, and drive revenue growth.

Performance Metrics and Analytics

Key Performance Indicators

To improve the productivity of insurance agents, you have to come up with and track the key performance indicators (KPIs) [1] KPIs are metrics that allow the insurance agencies to measure progress towards specific targets. Here are some of the fundamental KPIs that insurance agencies can utilize to evaluate the results of the activities of insurance agents.

- Sales targets: The KPI creates a sales target that is realistic, achievable, and essential to achieving the agency’s goals.

- Conversion rates: This KPI measures the percentage of leads an agent successfully converts into customers. A high conversion rate indicates that an agent is effective at closing deals.

- Customer retention: This KPI measures an agent’s ability to retain customers over time. Maintaining good relationships with existing customers increases the chances of repeat business.

- Activity levels: This KPI measures an agent’s productivity levels by tracking the number of calls, emails, and meetings they have with clients.

Through monitoring these KPIs, the insurance agencies would realize which areas the agents need to improve and take action accordingly. In another instance, if an agent has a low conversion rate, the agency can deliver extra training or assistance so that he or she can learn to be more successful.

Data-Driven Decision Making

Insurance agencies have to do data analysis and use it to work through agent productivity issues [2]. The notion of data-driven decision includes gathering and processing data to see patterns and trends so that an agency can use it to make informed decisions.

Customer Relationship Management (CRM) software is one possibility of data pulling. CRM systems enable an otherwise achievable tracking of customer interactions, sales data, and other metrics that are subsequently utilized for pinpointing the areas of work. Through this information usage by agencies, they can make decisions based on data about the adequacy of agents’ productivity, for example, which ones perform better and in which ones’ case more support is needed.

Apart from CRM software, insurance agencies may supplement the use of BI tools to interpret data and detect trends. BI software enables agencies to develop reports and dashboards that present actual-time information on agent performance, and on this basis, management makes decisions in due time.

Agencies that lean on data and analytics would see to it that agent productivity can be improved by taking deliberate steps to do so. Measurement of KPIs and integrated data makes it possible for companies to increase productivity, raise customer satisfaction, and succeed in their business development.

[1] Source: LeadSquared [2] Source: McKinsey & Company

Client Relationship Management

A successful insurance agent is aware that the foundation of development in this business is based on good client relationships. CRM or client relationship management is a tool to gain more customer satisfaction and retention as well as to be able to manage and keep client interactions.

Personalization Strategies

One of the approaches to making client relations better is individualization. Agents can achieve high levels of customer satisfaction and loyalty as a result of customizing their products and services according to client’s particular needs. The gathering of client data (age, gender, income, lifestyle) plays an important role here by facilitating the rendering of tailored solutions for the clients.

Agents can also monitor client interactions and preferences using CRM software. This helps them to offer customized recommendations and even subsequent communications. Through the process of carefully evaluating client’s requirements and tastes, agents may thus cultivate trust and loyalty which in the long run will generate bigger sales and referrals.

Client Retention Programs

Another important factor of CRM is client retention. Keeping existing customers is typically less expensive and can increase profits over time which is what is needed for business growth. Agents can design client retention programs like loyalty programs, referral programs, and exclusive offers to keep their clients with them.

CRM software can also automate the renewal process by sending customized emails to clients on their policy renewals or birthday wishes. A good agent can elevate client satisfaction and keep clients by staying in touch with and showing appreciation to the customers.

Conclusion

Insurance agents who aim to be more productive and grow their business should be well-versed in client relationship management. Agents can create robust customer relations by implementing a personalized strategy that involves retention programs, which in turn leads to more sales, referrals, and long-term business growth.