Are you searching for a loan that is reasonably priced, adaptable, and straightforward to apply for? Then, You might want to consider a Fintech Zoom Loans. The fintech Zoom loans provide you with different types of lending choices. Fintech Zoom provides us with different types of loans depending on the requirements and situations. For that, we are reviewing Fintech Zoom Loans for you.

What is a Fintech Zoom Loan?

It is the best platform for those who are looking for different types of lending options, you can calculate interest rates from their website. Now, We can say that Fintech Zoom is providing loans for those who are looking for low-interest rates. But you have to know that Fintech Zoom is not a lender they are providing different types of lender choices.

How do the Fintech Zoom loans work?

On their website, people can find various options for lenders depending on their specific needs. On the requirement of a loan, Fintech Zoom Loans shows the information as follows:

Fees: It will show all the details of fees when you apply for a loan, like organization costs, application fees, penalties, and late payment fees.

Interest: Interest rates will be easily shown depending on the loan amount and lender. On that basis, people can find the best option. Payback: As you find the lender and your required loan amount, you can get all the results of how much money you need to pay back on the timeline.

Ratings: People rate each lender and display an average rating. Depending on it, you can consider whether you should borrow a loan or not.

Which are loans available on Fintech Zoom?

Prosper:

- Offers personal loans with fair to average credit.

- The peer-to-peer lending model allows investors to lend.

- Definitively lower interest rates than traditional loans.

Lending Tree:

- Offers personal, student, and home loans.

- Competitive interest rates.

- Flexible payback terms.

SoFi Fintech:

- Offers personal, student, and mortgage loans.

- They are known for low interest rates and excellent customer service.

To make a decision, compare interest rates, expenses, and repayment terms with various lenders to be finalized.

Fintechzoom Best Credit Cards

| Card Name | Key Features | Points/Cash Back Details |

| American Express Platinum | Accessible on airport lounges (worldwide). Points on travel and dinner purchase | 5x on flights and hotels booking with American Express Travel |

| Wells Fargo Propel American Express | 5x on flights and hotel booking with American Express Travel | 3x on dining, 1x on other purchase |

| Bank of America Premium | Up to $100 airline credit annually. | 2x on travel and dining |

| Amazon Prime Visa | No foreign transaction fees | 5% at Amazon.com, 2% on restaurants |

| Chase Sapphire Preferred | Points on travel and dinner purchases | 2x travel and dinner, 1x other purchases |

| American Express Gold | Points on dining and supermarkets | 4x at restaurants and U.S. supermarkets (up to $25,000/year) |

| Discover it | Cashback on rotating categories (Quarterly) | 5% rotating categories, 1% on other purchase |

| Citi Double Cash | No annual fee | 1% on buy + 1% on pay |

| Capital One Venture | $100 Global Entry/TSA Pre-Check fee credit. | 2x on every purchase |

| U.S. Bank Altitude Card | Points on dining, 2x on streaming service. | 4x on dining, 2x on streaming services, 1x on other purchase |

Key features of the Fintech Zoom Loans.

If someone looking for a quick and simple online loan application process and doesn’t want to waste time on paperwork or personal visits. Then Fintech Zoom Loans will be a great platform with competitive interest rates and affordable repayment plans. Now you have a better option to select the most suitable repayment period based on your financial circumstances. If you have any inquiries or concerns during the loan application process Fintech Zoom customer service team is always ready to assist you.

How to apply for a loan on Fintech Zoom?

Following process is shown for those who want to apply for the loan on Fintech Zoom:-

- To apply for a loan, kindly access Fintech Zoom’s website.

- Just create a new account by clicking on the “Sign Up” button.

- Ensure that to provide the required information, such as your name, email, and password.

- Complete the application form with details: name, residence, employment history, income, and loan amount.

- Present required documents: ID verification, financial records, bank statements, and employment documentation.

- Upload documents securely using the Fintech Zoom platform.

Fintech Zoom Loans Suitability

- This will help for individuals dealing with unexpected expenses like medical bills, car repairs, or home emergencies.

- If someone is an entrepreneur or small business owner, this platform provides fast access to funds/loans.

- Those students who are struggling with tuition or other educational expenses are offering financial aid to them.

- Ideal for those valuing convenience with its user-friendly platform.

Fintech Zoom Loans Platform Overview

- With this platform, loans can take over without bank visits.

- It offers fair credit-based interest rates.

- For the borrowers, they provide flexible repayment options.

- It outlines clear loan terms and conditions for customer trust.

- It always provides loan assistance.

Conclusion

The Fintech Zoom Loans platform will provide all the necessary information that will help you select the best among all the available lenders. The best part about this platform is without physically visiting different lending options you can compare and choose what best suits you. Remember to always check all the required information and make sure that it is aligned with your needs.

If you want a better choice then try the Cup Loan Program.

Frequently Asked Questions

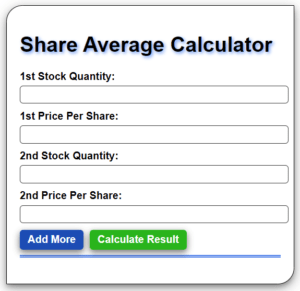

Que: How does the Fintech Zoom calculator work?

Ans: Fill in information such as the loan amount, its term, and down payment. The Fintech Zoom calculator will show you monthly payments, total payments, interest rates, and amortization schedules.

Que: Does the Fintech Zoom platform provide a loan?

Ans: No, this platform only connects borrowers to lenders. They are not lenders.

Que: What is the credibility of the Fintech Zoom platform?

Ans: The Fintech Zoom platform itself is not a lender. So, borrowers should go through the lender’s official website for all the information. Make sure to check the terms and conditions before applying.

Que: What types of loans one can get on Fintech Zoom?

Ans: The Fintech Zoom platform offers various loans e.g. personal loans, business loans, student loans, auto loans, etc.

1 thought on “Fintech Zoom Loans | Money Fintechzoom (2024)”