By investing in Best Choice Insurance, you will be protecting yourself, your family, and your assets from financial losses. Nevertheless, with so many insurance companies and various types of coverage offered, it takes a lot of time to decide which is best for you.

In one place you can save time and money by comparing insurance quotes from multiple providers by best choice insurance agency. Their agents can also assist with policy management and renewal, ensuring that you have the coverage you need when you need it. Whether you’re looking for auto, home, life, or business insurance, Best Choice Insurance can help you find the right policy at the right price.

Understanding Types of Best Choice Insurance

Term Life Insurance

If you are searching for insurance for a specific period of time usually between one and 30 years then term insurance can be considered. If the policyholder dies during the term of the policy, the beneficiary receives a payout. The term insurance gives financial relief to beneficiaries in case an insured person dies.

Whole Life Insurance

Unlike term life insurance, which only covers a specific period, whole life insurance provides coverage for the policyholder’s entire life. With this insurance, a policyholder can borrow against the policy or receive a payout if the policy is surrendered.

Health Insurance

Health insurance provides coverage for medical expenses. For doctor visits, hospital stays, prescription drugs, and more such things can be included in this coverage. Health insurance can be useful for individuals or provided by employers with the benefits of a package.

Auto Insurance

Auto insurance enables the compensation of vehicle damages or injuries that result from an accident involving a car. This involves the insuring of damage to the policyholder’s vehicle as well as possibly liability coverage in the event of hit-and-runs or damage or injuries caused to other people or property. Auto insurance is insinuated in many states.

Your insurance budget may be affected by your dependents as well as your level of risk. This must be taken into consideration when you choose an insurance cover.

Evaluating Best Choice Insurance Providers

Insurance is such an important financial vehicle that one should take the time to evaluate it before settling on a particular provider. Below are the key things to choose from when you’re looking for the best choice insurance provider.

Company Reputation

The foremost factor for determining insurance companies is always their reputations. A company that has a good image they are most likely to avail customer satisfaction and the company will be financially stable. What qualifies a company’s reputation can be judged from the ratings and reviews on websites like Investopedia and Forbes Advisor.

Policy Options

Another key part to look at is the matter of policies presented by an insurance company. The variations are wide among the insurance providers who sell many different policy options while there are those who sell only a few of them. There is an option that you can use such as finding an apt choice, going to the insurer’s website, or utilizing a comparative platform like GoodRx for comparing prices.

Customer Service

You need to pick up an insurance company that is simple to contact and allows you to receive a well-timed service. Evaluating a company’s customer service involves researching their ratings and review sites, for example, GoodRx, and NerdWallet.

Claims Process

The claims process is as equally important as the rest when determining which insurance company to go with. The insurance company should implement a claims processing system that is simple and prompt. In order to judge a company’s claims process performance, visit its experience and review ratings on websites like Healthinsurance. org.

When all these factors are considered, you can confidently select the right insurer that matches your needs as well as meets your budget.

Determining Coverage Needs

When picking an insurance policy, don’t forget to choose the right coverages so that you ensure there is enough protection. Here are some factors by best choice insurance to consider:

Individual vs Family Plans

The first step in planning your coverage is to decide if an individual or family is better for you. Having dependents requires you to pick a plan that includes everyone probably. Unlike this, if you are alone or your dependents are covered separately then, an individual plan would be more suitable.

Assessing Risk Factors

Another major aspect of your coverage requirements is the identification of your risk factors. For instance, in the case of a pre-existing condition, you might need more extensive coverage. Likewise, if you involve yourself in risky activities such as extreme sports, you may have to get additional coverage that will protect you against the resultant injuries.

Coverage Limits

Finally, just be careful to choose your plan based on cover limits and not just the name of your company. Check if you have enough knowledge of the boundaries of the policy you have and if they can be met with your requirements. To illustrate, suppose you get a cancer treatment that is very expensive. In such a situation, you may need a policy with more frequent coverage limits to avoid paying out of pocket.

A helpful factor to consider is the type of coverage that is required by you as it will help you to go for the plan that gives face-to-face covers.

Comparing Insurance Quotes

When looking for the best choice insurance policy, it’s important to compare quotes from different providers. Always consider the following factors when comparing insurance quotes:

Quote Accuracy

The precision of the quotation is vital as you may end up paying more for less coverage or less for more coverage than what is quoted. Accurate information that a person needs to provide is necessary to ensure that the quote obtained is as accurate as possible. Basically, in case of incorrect information, the quote will either be above or below the real cost of insurance.

Price Comparison

Price is a key consideration in choosing quotes and offers. Nevertheless, the coverage and benefits should be analyzed by the individual policy since a less expensive policy may not have high-quality coverage as opposed to a more expensive policy. It is imperative to match policies of similar coverage levels while purchasing to ensure that you are getting the best deal for your money.

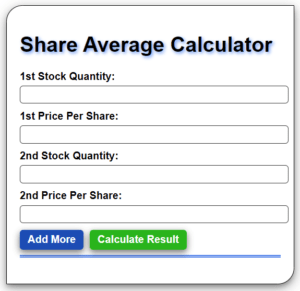

There is an array of selection methods for comparison that can be done by using an online comparison tool which requires you to enter your information once and in turn receive quotes from different providers. Such a procedure lets people save time and also makes the comparison of policies easy.

Policy Exclusions

A review of excluded risks in the policy is necessary to know what is not covered in the policy. Some policies lack the other damages or may restrict the coverage for some items. It will be useful to know these limitations before making a policy purchase in order to be sure you are buying enough coverage.

Overall, insurance quotes accuracy should not be forgotten, and price comparison and exclusions should be noted when doing a comparison. With consideration of these matters, you can make a choice and get the right insurance plan with the best choice insurance.

Conclusion

We have researched different insurance providers for you. The best choice insurance agency is providing top coverage for everyone. We have covered a variety of insurance in this article and you can study top insurance providers in 2024 by fintechzoom.